4506 C Form 2020

What is the 4506 C Form

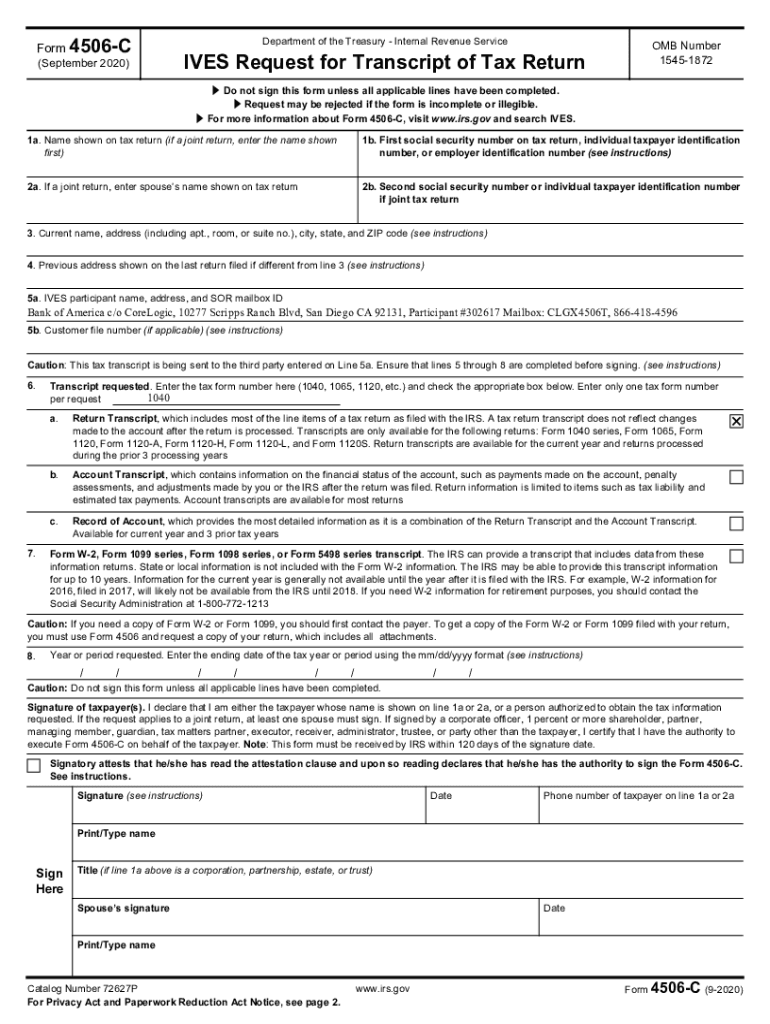

The 4506 C form, officially known as the "Request for Transcript of Tax Return," is a document used by taxpayers in the United States to request a transcript of their tax return information from the Internal Revenue Service (IRS). This form is particularly useful for individuals who need to verify their income for various purposes, such as applying for loans, mortgages, or government assistance. The 4506 C form allows the IRS to send the requested information directly to a third party, such as a lender or financial institution, ensuring that the data is accurate and up-to-date.

How to use the 4506 C Form

Using the 4506 C form involves a few straightforward steps. First, you need to fill out the form with your personal information, including your name, Social Security number, and address. Next, specify the type of transcript you are requesting and provide the name and address of the third party that will receive the transcript. After completing the form, sign and date it to authorize the IRS to release your tax information. Finally, submit the form to the IRS by mail or through an authorized e-filing service to ensure it is processed efficiently.

Steps to complete the 4506 C Form

Completing the 4506 C form requires attention to detail to ensure accuracy. Follow these steps:

- Provide your name and Social Security number in the designated fields.

- Include your current address and any previous addresses if applicable.

- Indicate the type of transcript you need, such as a tax return transcript or account transcript.

- Fill in the name and address of the third party receiving the transcript.

- Sign and date the form to authorize the release of your information.

Once completed, review the form for any errors before submitting it to the IRS.

Legal use of the 4506 C Form

The 4506 C form is legally binding, allowing the IRS to disclose your tax information to authorized third parties with your consent. This legal framework ensures that your sensitive information is handled appropriately and only shared with designated individuals or entities. It is essential to understand that any misuse of the form, such as providing false information or unauthorized requests, can lead to legal consequences, including penalties from the IRS.

Required Documents

When submitting the 4506 C form, you may need to provide additional documentation to support your request. This may include:

- A copy of your identification, such as a driver's license or passport.

- Proof of your current address, like a utility bill or bank statement.

- Any previous tax returns that may help verify your identity.

Having these documents ready can expedite the processing of your request and ensure that the IRS has all necessary information to fulfill your transcript request.

Form Submission Methods

The 4506 C form can be submitted to the IRS through various methods. The primary options include:

- Mail: Send the completed form to the appropriate IRS address based on your location.

- Online: Use an authorized e-filing service that supports the submission of the 4506 C form.

Choosing the right submission method can affect the speed of processing, so consider your needs when deciding how to submit the form.

Quick guide on how to complete 4506 c form

Accomplish 4506 C Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal green alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without any holdups. Manage 4506 C Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign 4506 C Form without hassle

- Obtain 4506 C Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form retrieval, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Modify and eSign 4506 C Form and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4506 c form

Create this form in 5 minutes!

How to create an eSignature for the 4506 c form

The best way to create an e-signature for a PDF document online

The best way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

The way to generate an e-signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is a 4506 C form?

The 4506 C form is a document used by the IRS to authorize the release of a taxpayer's tax return information to third parties. This form is especially important for lenders and financial institutions to verify an applicant's income during loan processing.

-

How does airSlate SignNow streamline the 4506 C form process?

airSlate SignNow simplifies the process of completing and submitting the 4506 C form by allowing users to fill it electronically and eSign it with ease. This reduces the time it takes to complete the form and minimizes errors commonly associated with paper submissions.

-

Is there a cost associated with using airSlate SignNow for the 4506 C form?

airSlate SignNow offers competitive pricing plans that cater to different business needs, making it a cost-effective solution for managing the 4506 C form. Users can choose from various subscription tiers based on their document volume and usage requirements.

-

What are the benefits of using airSlate SignNow for the 4506 C form?

Using airSlate SignNow for the 4506 C form provides several advantages, including faster processing times, enhanced security, and improved compliance. The platform also offers features like reminders and tracking to ensure timely completion of the form.

-

Can I integrate airSlate SignNow with other software for managing the 4506 C form?

Yes, airSlate SignNow offers integrations with a variety of applications such as CRM and document management systems. These integrations help streamline the workflow surrounding the 4506 C form, allowing users to manage documents more effectively.

-

How secure is the information submitted via the 4506 C form in airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including those containing sensitive information like the 4506 C form. The platform uses advanced encryption and compliance measures to ensure that all data remains secure and confidential.

-

What types of businesses can benefit from using airSlate SignNow for the 4506 C form?

A wide range of businesses, especially those in finance, accounting, and real estate, can benefit from using airSlate SignNow for the 4506 C form. It is particularly useful for lenders seeking to verify income for loan applicants, making it a vital tool in these industries.

Get more for 4506 C Form

- On the day of in the year before me the undersigned form

- Time and material rates and prices in accordance with the schedule of labor and materials attached form

- State of new york including any uniform premarital agreement act or other applicable laws

- And 490203057 form

- Real estate other than residence schedule a form

- Expedited handling services new york state department form

- The corporation is not form

- Insert name of domestic professional service corporation form

Find out other 4506 C Form

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself